+$250.000

Real Estate Investment in

Turkey

Real Estate Investment & Costs

Title Deed Transfer Tax

2%-4%

Attorney Fees

$2.500-$4.000

Notary & Registry Fees

- Registry Fees: $250-$750

- Notary Fees: $100 – $1.500

Valuation Fee

$2.500

Mandatory Earthquake Insurance

$500

Orhun Doğanay

International Property Investment Expert

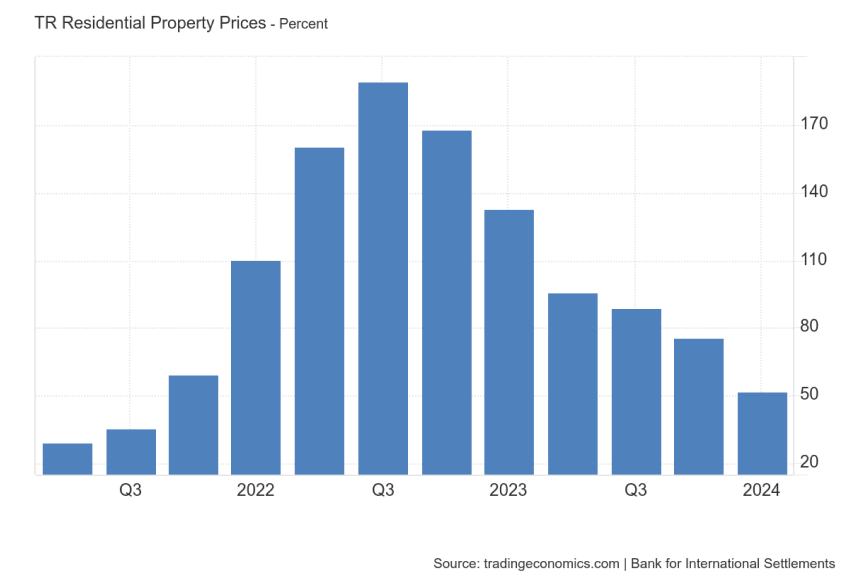

House Price Index in Turkey

Turkey

Orhun Doğanay

International Property Investment Expert

Speak to an RCBI Expert

Reach out Right Now

Our team of experts will reach out to you shortly after send your inquiry.

Frequently Asked Questions

Can foreigners buy property in Turkey?

Yes, most foreign nationals can buy property in Turkey, with few restrictions. Some regions, like military zones, may have limitations, but in major cities and coastal areas, foreigners are free to purchase properties.

Is buying property in Turkey a good investment?

Yes, Turkey offers consistent property value appreciation, particularly in fast-growing cities like Istanbul, Izmir, and Antalya. With growing tourism and infrastructure projects, property investment in Turkey offers solid rental yields and long-term growth potential.

Can foreigners get a mortgage in Turkey?

Yes, foreigners can access mortgages from Turkish banks, often with favorable interest rates. Additionally, many developers offer installment payment plans, making it easier for international buyers to invest.

What are the key costs involved in buying property in Turkey?

Besides the property price, buyers should account for a title deed transfer tax (4% of the property’s sale value), notary and legal fees, and utility connection fees. Property taxes in Turkey are relatively low compared to other countries, making ownership more affordable in the long run.

Does buying property in Turkey grant residency or citizenship?

Yes, purchasing property worth at least $400,000 qualifies you for Turkish citizenship. Additionally, lower-valued property purchases allow you to apply for renewable residency permits, offering flexibility and future planning advantages.

What type of properties are available to foreigners in Turkey?

Foreign buyers can choose from a wide range of properties, including seaside villas, modern city apartments, and even commercial real estate. Turkey’s diverse landscape offers options for every investor, whether for vacation homes, retirement, or rental income.

Are there any advantages to buying property in Turkey compared to other countries?

Besides affordability and appreciation, Turkey’s investment market offers an underappreciated benefit—the option to rent your property to a growing tourist market, especially in coastal regions. This not only provides rental income but also offsets property maintenance costs.

How long does the property buying process take for foreigners in Turkey?

The process is typically quick, often taking only 3-6 weeks. Turkey’s streamlined property acquisition system is designed to make the experience seamless for international buyers, with the bonus of not needing to be physically present to complete the transaction.

What taxes do foreign property owners pay in Turkey?

Foreign property owners are subject to annual property taxes, typically around 0.2% to 0.6% of the property’s assessed value. In addition, rental income is taxable, though Turkey’s tax system offers generous deductions on rental income, allowing investors to minimize tax liabilities.

Can I sell my property in Turkey at any time, and are there restrictions on repatriating funds?

Yes, you can sell your property at any time, and there are no restrictions on repatriating funds. Turkey’s flexible regulations ensure that foreign investors can easily transfer sale proceeds back to their home country without additional bureaucratic hurdles.