+$250.000

Real Estate Investment in

Portugal

Real Estate Investment & Costs

Property Transfer Tax (IMT - Imposto Municipal sobre Transmissões)

2%-8%

Homeowners Insurance

€850

Stamp Duty & Notary Fees

- Stamp Duty: 0,8%

- Notary Fees: €1.200

Orhun Doğanay

International Property Investment Expert

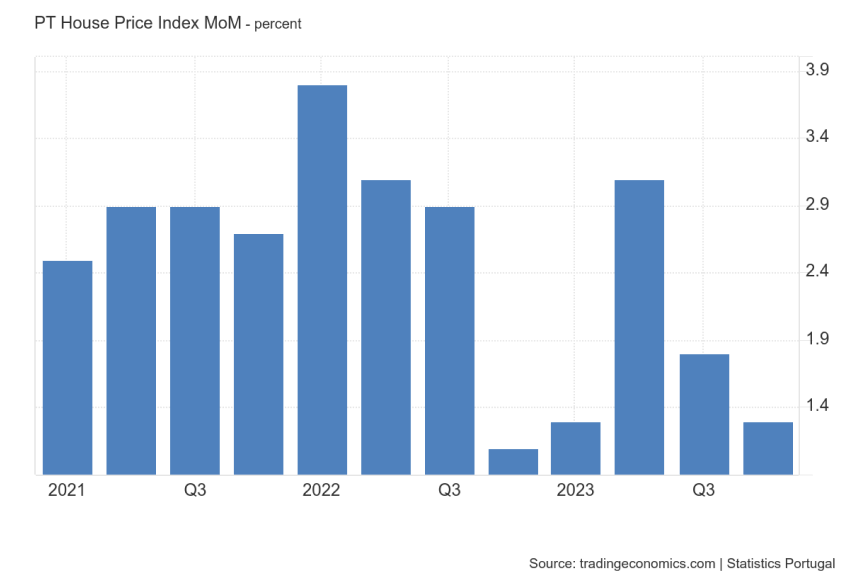

House Price Index in Portugal

Portugal

Orhun Doğanay

International Property Investment Expert

Speak to an RCBI Expert

The GMC team has global experts in over 20 countries. We can advise in 14 languages.

Let us help you find the perfect investment migration solution.

Reach out Right Now

Our team of experts will reach out to you shortly after send your inquiry.

Frequently Asked Questions

Can foreigners buy property in Portugal?

Yes, Portugal has no restrictions on foreigners buying property. Whether you’re an EU or non-EU citizen, the process is straightforward, though non-EU citizens may need to appoint a tax representative in Portugal.

Do I need a tax number (NIF) to buy property in Portugal?

Yes, all foreigners need a NIF (Número de Identificação Fiscal), which is a tax identification number, to purchase property. This can be obtained from a local tax office or through a lawyer.

What are the main taxes and fees involved in buying property in Portugal?

- The key costs include:

- Property Transfer Tax (IMT): Ranges from 2% to 8% depending on the value of the property.

- Stamp Duty: 0.8% of the property value.

- Notary and registration fees: Around 1% of the property price.

Can foreigners get a mortgage in Portugal?

Yes, Portuguese banks offer mortgages to foreigners. Non-residents can typically borrow 65-75% of the property’s value, while residents may secure up to 80-90% with favorable terms depending on credit history.

What is the minimum deposit required for buying property in Portugal?

The minimum deposit usually ranges from 10% to 30% of the property’s price, depending on the bank and your residency status. A promissory contract is often signed during this phase.

What is a CPCV (Promissory Contract) in Portugal?

The CPCV (Contrato Promessa de Compra e Venda) is a promissory contract signed after the deposit is paid. It outlines the terms of the sale and legally binds both parties to the agreement.

Are there additional benefits for foreigners buying property in Portugal?

Yes, purchasing property worth €500,000 or more may qualify you for the Golden Visa, granting residency and visa-free access to the Schengen Zone, a significant advantage for non-EU buyers.

How long does the property purchase process take in Portugal?

The buying process typically takes 2-3 months, depending on legal and financial requirements, especially if you’re applying for a mortgage.

What are the annual property taxes in Portugal?

Property owners pay an annual Municipal Property Tax (IMI), ranging from 0.3% to 0.8% of the property’s taxable value, depending on the location.

Can I rent out my property in Portugal?

Yes, renting out property is a popular investment strategy in Portugal, especially for short-term rentals in tourist areas, offering attractive rental yields.