+€100.000

Real Estate Investment in

Germany

Real Estate Investment & Costs

Property Transfer Tax (Grunderwerbsteuer)

3,5%-6,5%

Notary Fees (Notarkosten)

1,0%-1,5%

Registration Fees (Grundbuchkosten)

0,5%-0,9%

Orhun Doğanay.

International Property Investment Expert

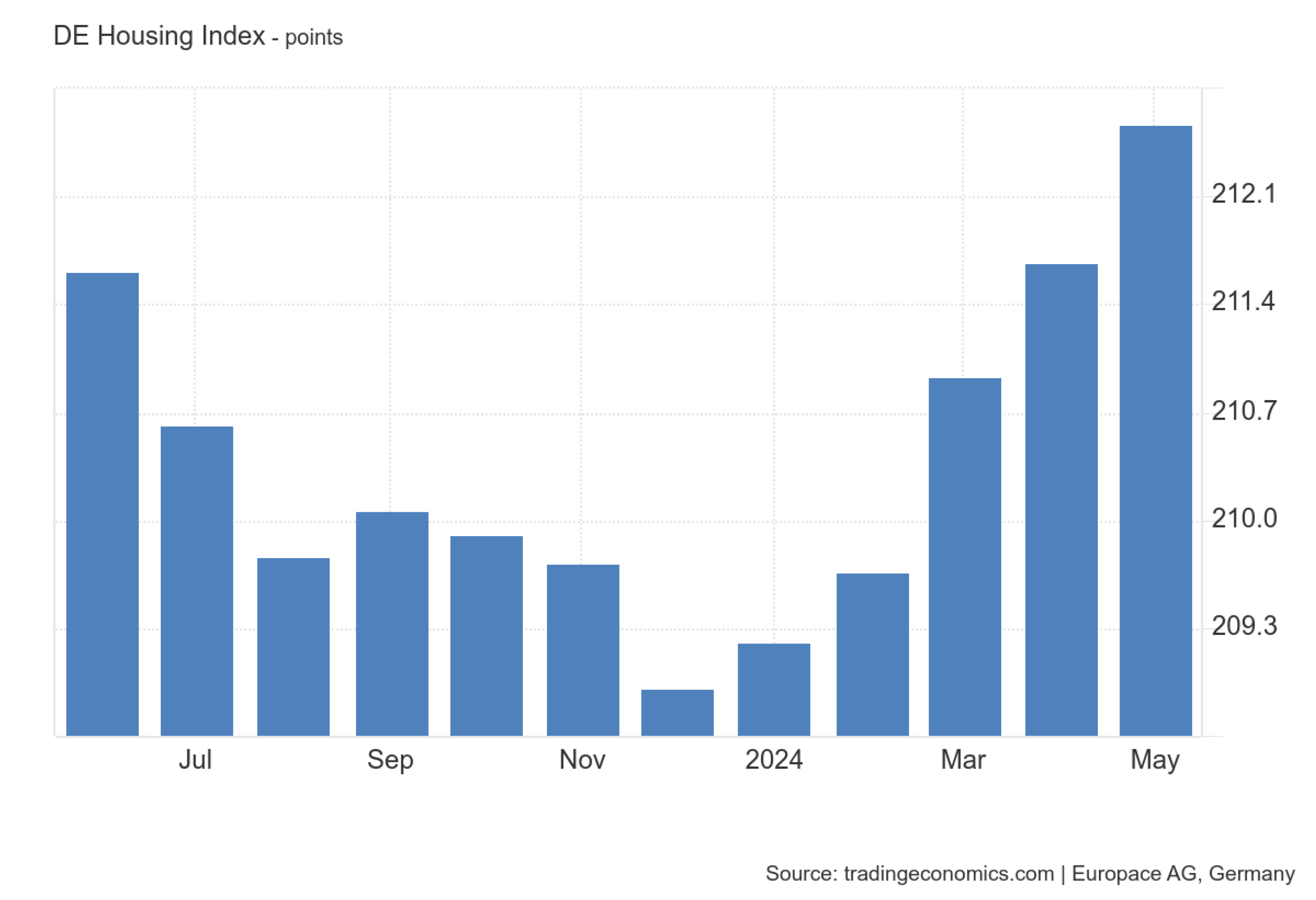

House Price Index in

Germany

Orhun Doğanay

International Property Investment Expert

Speak to an RCBI Expert

Reach out Right Now

Our team of experts will reach out to you shortly after send your inquiry.

Frequently Asked Questions

Can foreigners buy property in Germany?

Yes, Germany has no restrictions on property ownership for foreigners. Both EU and non-EU nationals can purchase property in Germany without needing special permissions or residency. Foreign buyers enjoy the same legal protections and rights as German nationals when purchasing real estate.

What are the main costs involved in buying property in Germany?

In addition to the purchase price, buyers need to account for several additional costs, including:

- Property Transfer Tax (3.5% to 6.5% of the purchase price, depending on the state).

- Notary Fees (around 1.0% to 1.5% of the purchase price).

- Registration Fees (approximately 0.5% of the purchase price).

- GMC Advisory Fees (3% of the purchase price, including VAT).

*These costs typically add up to 7%–10% of the property value.

Do I need to physically be in Germany to buy property?

While it is not mandatory to be present in Germany to purchase real estate, it is highly recommended to visit the property before finalizing the transaction. You can, however, complete the purchase remotely through a trusted representative, such as GMC Germany advisor or a GMC attorney with a power of attorney, who can manage the paperwork and contracts on your behalf.

What are the financing options available for foreigners in Germany?

Foreigners can apply for mortgages from German banks, though lending criteria may differ depending on your residency status and the bank’s policies. Generally, you will need a deposit of at least 20%–30% of the property value, and some banks may require proof of income or assets in Germany. Non-EU nationals may face stricter lending terms compared to EU nationals or residents.

What taxes do foreigners have to pay when buying property in Germany?

When purchasing real estate in Germany, foreigners are subject to the same taxes as German nationals, including:

- Property Transfer Tax (3.5% to 6.5% depending on the region).

- Annual Property Tax (calculated based on the property value and municipal tax rate).

- Capital Gains Tax if the property is sold within 10 years, unless it’s your primary residence.

*You can find more about the taxes related to investing into a property in Germany from our blog.

Are there any restrictions on renting out property in Germany as a foreigner?

No, there are no restrictions on foreigners renting out property in Germany. Many foreign investors buy properties for rental income. However, you will need to comply with German rental laws, which are tenant-friendly. This includes regulations on rental contracts, rent increases, and tenants’ rights.

What legal steps are involved in purchasing property in Germany?

The key legal steps in purchasing property in Germany are:

- Signing the purchase contract: This must be done in front of a notary, who ensures the legality of the transaction.

- Paying the purchase price and associated taxes/fees.

- Registering the property: The notary will submit the purchase agreement to the land registry (Grundbuch) to formally transfer ownership to the buyer.

Do I need a notary to buy property in Germany?

As a foreign buyer, you will generally need the following documents:

- A valid passport or ID.

- Proof of financing or a mortgage agreement (if applicable).

- Bank account details for the transaction.

- Any required visas or residence permits (if applicable).

*Additional documents may be required depending on the nature of the transaction and your residency status.

Can buying property in Germany lead to residency or citizenship?

No, buying property in Germany does not automatically grant residency or citizenship. However, purchasing property can support a residency application if you plan to live in the country and meet other visa requirements. Germany does not offer a citizenship-by-investment program, but property ownership may be beneficial in the long-term application for permanent residency or citizenship if other criteria are fulfilled.