+$250.000

Real Estate Investment in

UAE

Real Estate Investment & Costs

Dubai Land Department (DLD) Fees

4%

Property Registration Fees

AED 5.000-AED 10.000

Insurance Costs & Notary Fees

- Insurance Costs: AED 2.000 – AED 5.000

- Notary Fees: AED 1.000 – AED 3.000

Property Valuation Fee

AED 3.000

Orhun Doğanay

International Property Investment Expert

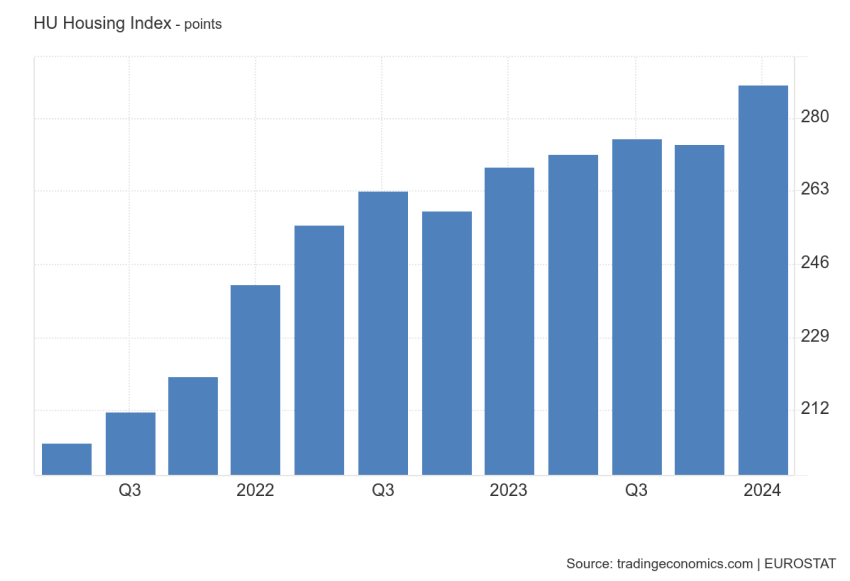

House Price Index in United Arab Emirates

UAE

Orhun Doğanay

International Property Investment Expert

Speak to an RCBI Expert

The GMC team has global experts in over 20 countries. We can advise in 14 languages.

Let us help you find the perfect investment migration solution.

Reach out Right Now

Our team of experts will reach out to you shortly after send your inquiry.

Frequently Asked Questions

Can foreigners buy property in the UAE?

Yes, foreigners can buy property in designated freehold areas in the UAE, such as parts of Dubai, Abu Dhabi, and Ras Al Khaimah. These areas allow non-UAE nationals to purchase property outright without any restrictions.

What are freehold and leasehold properties in the UAE?

Freehold properties give foreign buyers full ownership of the land and property. In contrast, leasehold properties are typically leased for up to 99 years, and ownership of the land remains with the local government or original owner.

What is the minimum property investment required for a UAE residency visa?

In Dubai, a minimum property investment of AED 750,000 qualifies foreign buyers for a 3-year residency visa. For a 5-year visa, the required investment is typically around AED 2 million. Different emirates may have slightly varied rules.

What are the taxes and fees when buying property in the UAE?

Property transactions in the UAE are tax-free, but there are certain fees:

- Dubai Land Department (DLD) fee: 4% of the property price.

- Agent fees: Typically around 2% of the property price.

- Notary and registration fees: These vary but usually range between AED 1,000 to AED 3,000 depending on the property.

Can I get a mortgage in the UAE as a foreigner?

Yes, foreigners can obtain mortgages in the UAE. Typically, banks offer up to 75-80% financing for UAE residents and 50-60% for non-residents, depending on the buyer’s financial profile and the property’s value.

How long does the property buying process take in the UAE?

The property buying process in the UAE generally takes between 30 to 60 days, depending on factors like securing financing, legal documentation, and registration with the Dubai Land Department (DLD) or relevant authorities in other emirates.

What are the best areas for foreigners to buy property in the UAE?

Popular freehold areas for foreigners include:

- Dubai: Palm Jumeirah, Downtown Dubai, Dubai Marina.

- Abu Dhabi: Saadiyat Island, Al Reem Island, Yas Island.

- Ras Al Khaimah: Al Hamra Village, Mina Al Arab.

What are the ongoing costs after purchasing property in the UAE?

- The main ongoing costs include:

- Service charges: These are paid to maintain shared facilities like pools, gyms, and gardens and vary based on the property type and location.

- Utilities: Electricity, water, and air conditioning costs depend on usage.

- Insurance: Optional but recommended for the property and its contents.

Is rental income taxed in the UAE?

No, rental income is tax-free in the UAE, making it a highly attractive option for property investors looking for consistent rental returns.

Can I rent out my property in the UAE?

Yes, as a property owner, you can rent out your property, especially in high-demand areas like Dubai and Abu Dhabi, where rental yields can range from 5% to 8% per annum. Short-term rental platforms like Airbnb are also becoming increasingly popular in the UAE.