+$250.000

Real Estate Investment in

Greece

Investment Options

Real Estate Investment & Costs

Property Transfer Tax

3%

Value Added Tax (VAT)

24% (foreigners are exempt)

Legal Fees & Notary Fees

- Legal Fees: 1,5%-2%

- Notary Fees: 2%

Property Survey Costs

€1.000

Orhun Doğanay

International Property Investment Expert

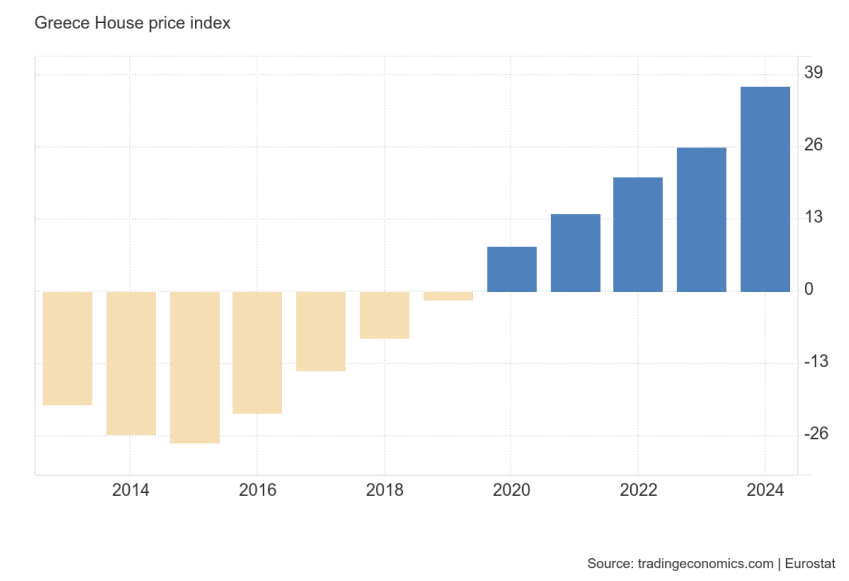

House Price Index in Greece

Greece

Orhun Doğanay

International Property Investment Expert

Speak to an RCBI Expert

The GMC team has global experts in over 20 countries. We can advise in 14 languages.

Let us help you find the perfect investment migration solution.

Reach out Right Now

Our team of experts will reach out to you shortly after send your inquiry.

Frequently Asked Questions

Can foreigners buy property in Greece?

Yes, foreigners can buy property in Greece without restrictions. You just need a Greek tax registration number (AFM) and to prove the ability to transfer the funds needed for the property purchase.

Do I need a tax number (AFM) to buy property in Greece?

Yes, a Greek tax number (AFM) is required for any property transaction. This number is used for tax purposes and must be presented to a notary during the purchase

What are the main taxes and fees involved in buying property in Greece?

The primary taxes and fees include:

- Property Transfer Tax: 3% of the purchase price for existing properties.

- VAT: 24% for newly built properties.

- Notary fees: Typically between 0.8% and 1.2% of the property price.

- Legal fees: Around 1% to 2%

Can foreigners get a mortgage to buy property in Greece?

Yes, although securing a mortgage in Greece can be challenging for non-residents. Generally, banks offer loans up to 70-75% of the property’s value, but you may need to negotiate terms with your home bank.

What is the Golden Visa program, and how does it relate to buying property in Greece?

The Greek Golden Visa program grants residency to non-EU citizens who purchase real estate worth at least €400,000. This visa allows you and your family to live and travel freely within the Schengen Zone.

What is the buying process like in Greece?

The process involves selecting a property, hiring a lawyer, securing a tax number (AFM), performing legal checks on the property, signing a promissory contract, and finalizing the sale with a notary.

Are there any risks when buying property in Greece?

Potential risks include issues with title deeds, unpaid taxes by the previous owner, and bureaucratic delays. Working with a lawyer is highly recommended to avoid these issues.

What is a typical down payment when buying property in Greece?

The typical down payment is around 10% of the purchase price when signing the promissory contract. This secures the property while the legal and financial processes are completed.

Can I rent out my property in Greece?

Yes, renting out property is a common investment strategy in Greece, particularly in tourist areas such as Athens, Santorini, and Mykonos, where rental yields are high due to year-round tourism.

How long does the property buying process take in Greece?

The process generally takes 1-3 months, depending on the complexity of the legal checks and the buyer’s financial arrangements. Obtaining financing or dealing with complex legal issues can extend this timeframe.