+£100.000

Real Estate Investment in

UK

Real Estate Investment & Costs

Stamp Duty Land Tax (SDLT)

2%-14%

Solicitor Fees

£1.000-£2.000

Property Survey Costs

- Homebuyer’s report: £400 – £800

- Full structural survey: £600 – £1,500

Land Registration Fee

£1.850

Orhun Doğanay

International Property Investment Expert

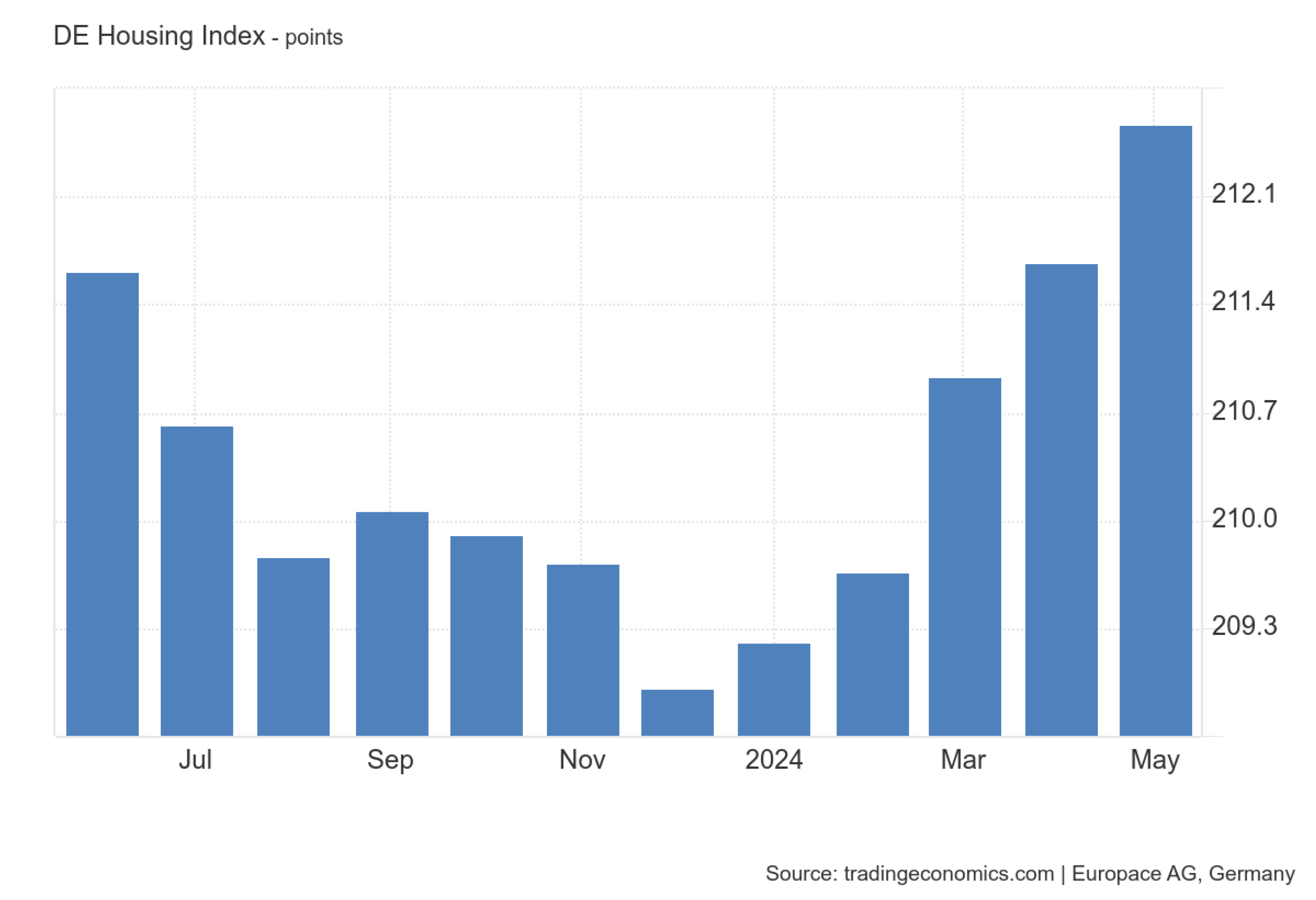

House Price Index in United Kingdom

UK

Orhun Doğanay

International Property

Investment Expert

Speak to an RCBI Expert

The GMC team has global experts in over 20 countries. We can advise in 14 languages.

Let us help you find the perfect investment migration solution.

Reach out Right Now

Our team of experts will reach out to you shortly after send your inquiry.

Frequently Asked Questions

Can foreigners buy property in the UK?

Yes, there are no restrictions on foreign nationals purchasing property in the UK. Non-residents and non-citizens can freely buy property.

Are there additional taxes for foreigners buying property in the UK?

Yes, non-residents are subject to a 2% Stamp Duty Land Tax (SDLT) surcharge in addition to the standard rates, which apply to properties over £40,000.

Do I need a visa or residency to purchase property in the UK?

No, you do not need to be a UK resident or hold a visa to buy property. However, owning property in the UK does not automatically grant residency.

Can foreigners get a mortgage in the UK?

Yes, foreigners can apply for a mortgage, but lenders may have stricter requirements, such as larger deposits (often 25-40%) and more documentation to verify income and creditworthiness.

What are the costs associated with buying property in the UK as a foreigner?

Key costs include the property purchase price, Stamp Duty Land Tax (with a 2% surcharge for non-residents), legal fees, property surveys, mortgage fees (if applicable), and land registration fees.

Is there a minimum investment amount to qualify for a UK property purchase?

No, there is no minimum investment threshold for buying property. However, for properties priced at or above £40,000, Stamp Duty Land Tax and other costs apply.

How long does the property purchase process take in the UK?

The process typically takes between 8 to 12 weeks from the time an offer is accepted, though this can vary depending on the complexity of the sale and whether a mortgage is involved.

Do foreigners have to pay Capital Gains Tax when selling UK property?

Yes, non-resident investors are subject to Capital Gains Tax (CGT) on any profits made from selling a UK residential property. The rates are 18% for basic rate taxpayers and 28% for higher rate taxpayers.

Can I rent out my property after purchasing it?

Yes, you are allowed to rent out your property in the UK. Many foreign investors purchase property with the intention of generating rental income. However, you will need to comply with local landlord regulations and tax laws.

Does buying property in the UK grant citizenship or residency?

No, buying property in the UK does not grant residency or citizenship. To obtain residency, you would need to apply through one of the UK’s visa programs, such as the Investor Visa (Tier 1).