+$150.000

Real Estate Investment in

USA

Real Estate Investment & Costs

Title Insurance

$1.000-$5.000

Attorney Fees

$1.500-$4.000

Notary & Registry Fees

- Registry Fees: $250-$750

- Notary Fees: $500 – $1.000

Escrow Fees

1%-1,5%

Property Tax (Annual)

0,5%-2,5%/annual

Inspection Fees

$550-$750

Homeowners Insurance

$1.000-$3.000/annual

Orhun Doğanay

International Property Investment Expert

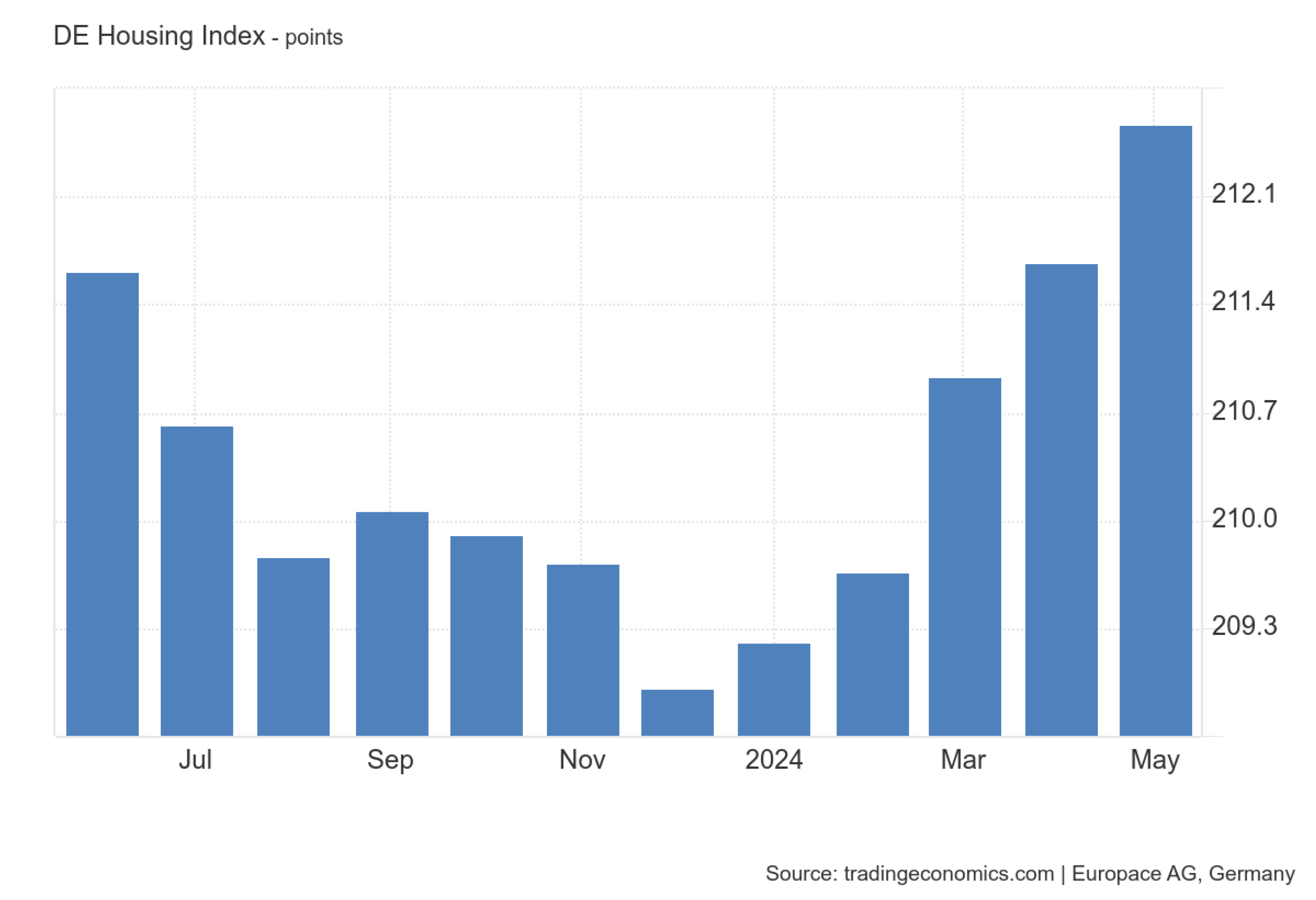

House Price Index in

USA

Orhun Doğanay

International Property Investment Expert

Speak to an RCBI Expert

Reach out Right Now

Our team of experts will reach out to you shortly after send your inquiry.

Frequently Asked Questions

Can foreigners buy property in the USA?

Yes, there are no restrictions on foreign nationals buying property in the USA. Both non-resident aliens and resident aliens can purchase real estate in the country.

Do I need a visa or green card to buy property in the USA?

No, you do not need a visa or green card to buy property. However, owning property in the USA does not grant residency, work rights, or a visa.

Can foreigners get a mortgage to buy property in the USA?

Yes, foreigners can apply for a mortgage, but lenders may require a larger down payment (typically 30-50%) and more extensive documentation to verify income, assets, and financial status.

Are there additional taxes for foreigners buying property in the USA?

No additional taxes apply to foreigners during the property purchase. However, when selling the property, foreign owners are subject to withholding under the Foreign Investment in Real Property Tax Act (FIRPTA).

What are the key costs involved in purchasing a property in the USA as a foreigner?

Key costs include the down payment, closing costs (usually 2-5% of the property price), property taxes, legal fees, home inspection fees, and ongoing costs such as homeowners insurance and HOA fees (if applicable).

Do foreigners have to pay property taxes in the USA?

Yes, foreigners must pay property taxes, which are assessed by local governments and vary depending on the property’s location. Property taxes generally range from 0.5% to 2.5% of the property value annually.

Can foreigners rent out their property in the USA?

Yes, foreigners can rent out their property in the USA. However, rental income is subject to US income tax, typically at a rate of 30%, unless you elect to treat the income as effectively connected with a US trade or business, allowing deductions for expenses.

Are there any restrictions on the types of property foreigners can purchase in the USA?

No, foreigners can purchase all types of properties, including residential, commercial, and rental properties, with no restrictions.

Does buying property in the USA grant residency or citizenship?

No, buying property in the USA does not grant residency or citizenship. Foreign buyers must apply for appropriate visas or residency through other immigration channels, such as the EB-5 Investor Visa program.

What happens when a foreigner sells property in the USA?

When selling property, foreign owners are subject to FIRPTA, which requires buyers to withhold 15% of the sale price for tax purposes. The seller may then file a US tax return to determine the actual capital gains tax owed, which is generally 15-20% depending on various factors.